UK Stocks to Watch: Nvidia, Intel, BP

UK Stocks to Watch: Market Trends and Insights

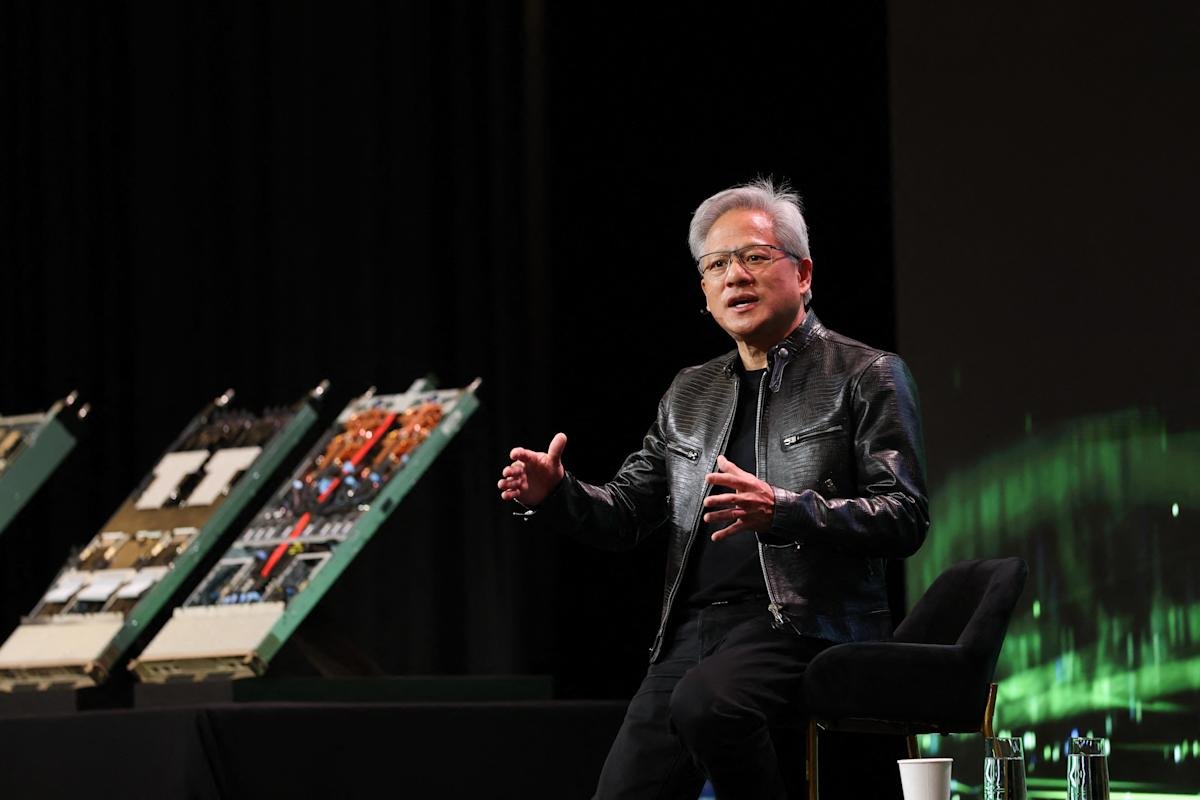

The UK stock market has been experiencing significant fluctuations, with trending tickers including Nvidia, Intel, and BP. These companies have been making headlines with their recent performances and announcements. The behaviour of these stocks can greatly impact the overall market sentiment.

Investors are keenly watching the tech sector, particularly Nvidia and Intel, as they navigate the challenges of the current market. The colour of their financial reports will be crucial in determining their future prospects. Meanwhile, energy giant BP is also under scrutiny, with its stock price being influenced by global events and market trends.

Pharmaceutical company Moderna has also been in the news, with its stock price being affected by the latest developments in the healthcare sector. Vistry, a UK-based construction company, is another stock that has been gaining attention from investors. To analyse the performance of these stocks, it is essential to consider the broader market context and the factors that influence their behaviour.

The current market trends are characterised by a high degree of uncertainty, with investors being cautious about their investments. However, this also presents opportunities for those who are willing to take calculated risks. By keeping a close eye on the trending tickers and staying up-to-date with the latest news and developments, investors can make informed decisions about their investments.

In conclusion, the UK stock market is complex and influenced by a wide range of factors. To navigate this complex landscape, investors need to stay informed and adapt to changing market conditions. By doing so, they can maximise their returns and achieve their investment goals. The UK stock market is expected to continue to evolve, with new trends and opportunities emerging all the time.

As investors look to the future, they will be keenly watching the performance of trending tickers like Nvidia, Intel, and BP. These companies have the potential to shape the direction of the market, and their stocks will be closely monitored by investors. The next few months will be crucial in determining the trajectory of the UK stock market, and investors will need to be vigilant to stay ahead of the curve.

The UK stock market is not just about the trending tickers, but also about the broader economic context. The government’s policies and regulations can have a significant impact on the market, and investors need to be aware of these factors. By considering the bigger picture, investors can make more informed decisions about their investments and achieve their long-term goals.

Furthermore, the UK stock market is influenced by global events and trends. The performance of international markets, such as the US and Europe, can have a significant impact on the UK market. Investors need to be aware of these global trends and factor them into their investment decisions. By doing so, they can maximise their returns and achieve their investment objectives.

In addition to the trending tickers, there are many other companies that are worth watching in the UK stock market. These companies may not be as well-known as some of the bigger players, but they have the potential to deliver strong returns for investors. By doing their research and staying up-to-date with the latest news and developments, investors can identify these opportunities and make informed decisions about their investments.

Overall, the UK stock market is a complex and dynamic environment, with many different factors at play. To succeed, investors need to be well-informed, adaptable, and willing to take calculated risks. By following the trending tickers and staying up-to-date with the latest news and developments, investors can navigate this complex landscape and achieve their investment goals.

The UK stock market is constantly evolving, with new trends and opportunities emerging all the time. Investors need to be vigilant and proactive to stay ahead of the curve. By doing so, they can maximise their returns and achieve their long-term investment objectives. The future of the UK stock market looks promising, with many opportunities for investors to grow their wealth.

Investors who are looking to invest in the UK stock market need to be aware of the risks and challenges involved. The market can be volatile, and there are many factors that can impact the performance of stocks. However, by doing their research and staying up-to-date with the latest news and developments, investors can make informed decisions about their investments and achieve their goals.

In order to succeed in the UK stock market, investors need to have a clear understanding of the market trends and insights. They need to be able to analyse the performance of different stocks and make informed decisions about their investments. This requires a combination of knowledge, skills, and experience, as well as a willingness to take calculated risks.

By following the trending tickers and staying up-to-date with the latest news and developments, investors can gain a deeper understanding of the UK stock market. They can learn about the different factors that influence the market, such as economic trends, government policies, and global events. This knowledge can help them make more informed decisions about their investments and achieve their long-term goals.

The UK stock market is a complex and dynamic environment, with many different factors at play. To succeed, investors need to be well-informed, adaptable, and willing to take calculated risks. By following the trending tickers and staying up-to-date with the latest news and developments, investors can navigate this complex landscape and achieve their investment goals. The UK stock market has the potential to deliver strong returns for investors, but it requires a combination of knowledge, skills, and experience to succeed.