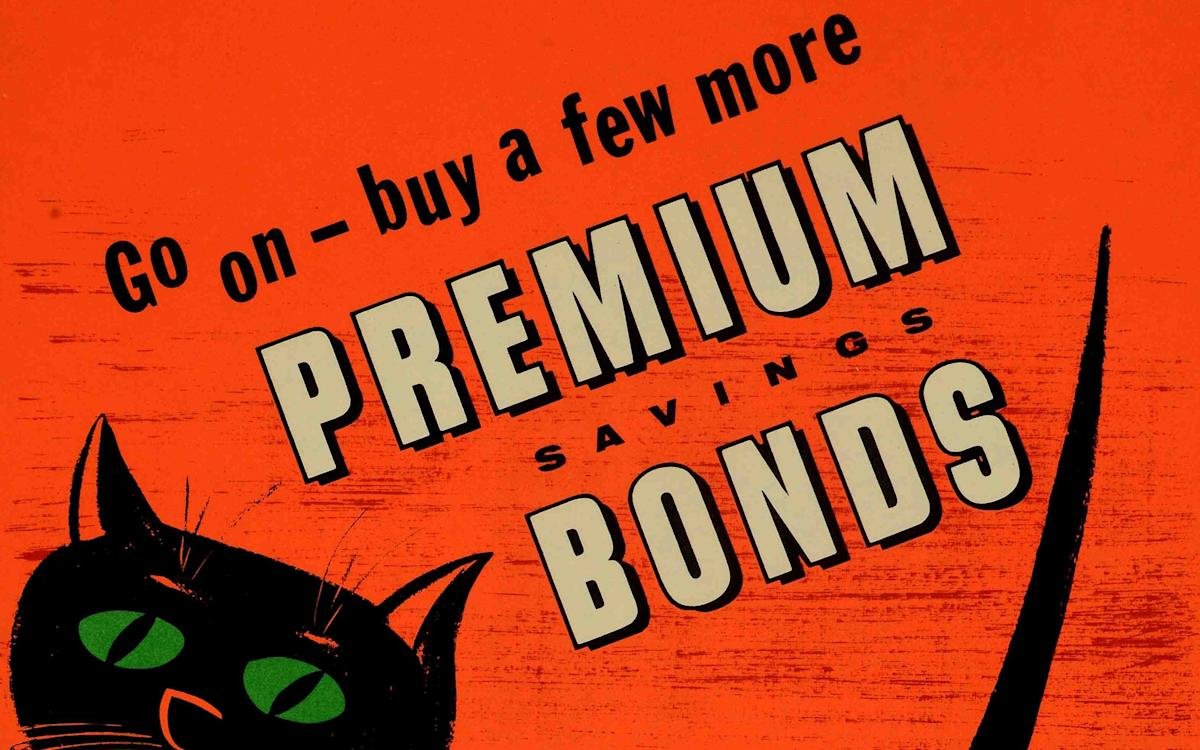

Premium Bonds 2026: Worth Investing?

Premium Bonds: A Comprehensive Guide

Premium Bonds are a popular savings option in the UK, offering a unique blend of security and potential returns. They are provided by National Savings and Investments (NS&I), a state-owned savings bank. With over 21 million customers, Premium Bonds have become a staple of British personal finance.

The main appeal of Premium Bonds lies in their tax-free prizes, which range from £25 to £1 million. Each £1 bond has an equal chance of winning, making it a fascinating option for those seeking a low-risk investment. However, it’s essential to analyse the odds and potential returns before investing.

In 2026, the Premium Bonds interest rate and prize structure remain unchanged. The odds of winning remain at 1 in 34,500, with an estimated 3.15 million prizes awarded each month. To maximise your chances, it’s crucial to understand the rules and behaviour of the bonds. You can purchase bonds online, by phone, or by post, with a minimum investment of £25.

Despite their popularity, Premium Bonds may not be the most lucrative investment option. With inflation rising, it’s vital to consider alternative savings methods, such as ISAs or fixed-rate bonds. Nevertheless, Premium Bonds offer a unique combination of security, tax-free returns, and the thrill of potentially winning a life-changing prize.

To determine whether Premium Bonds are worth investing in, it’s essential to assess your personal financial goals and risk tolerance. If you’re seeking a low-risk, long-term investment with the potential for tax-free returns, Premium Bonds might be an attractive option. However, if you’re looking for higher returns or more flexibility, you may want to explore alternative investments.

In conclusion, Premium Bonds remain a popular choice for UK savers, offering a unique blend of security and potential returns. While they may not be the most lucrative option, their tax-free prizes and low-risk nature make them an attractive choice for those seeking a stable investment. As with any investment, it’s crucial to carefully consider your options and behaviour before making a decision.

Ultimately, the decision to invest in Premium Bonds depends on your individual circumstances and financial goals. By understanding the rules, potential returns, and risks associated with Premium Bonds, you can make an informed decision and potentially reap the rewards of this unique investment opportunity.

With the UK economy facing uncertainty, it’s more important than ever to make informed investment decisions. By analysing the pros and cons of Premium Bonds and considering your personal financial situation, you can navigate the complex world of savings and investments with confidence.

In the world of personal finance, it’s essential to stay up-to-date with the latest developments and trends. Whether you’re a seasoned investor or just starting out, understanding the intricacies of Premium Bonds can help you make the most of your savings and achieve your long-term financial goals.

As the UK’s personal finance landscape continues to evolve, Premium Bonds remain a steadfast option for those seeking a low-risk investment. By providing a unique combination of security, tax-free returns, and potential prizes, Premium Bonds have become an integral part of British savings culture.

For those looking to invest in Premium Bonds, it’s essential to understand the rules and regulations surrounding these savings products. From the minimum investment amount to the tax implications, being informed is key to making the most of your investment.

In addition to their potential returns, Premium Bonds also offer a sense of community and camaraderie among investors. With millions of people invested in Premium Bonds, there’s a shared excitement and anticipation surrounding each monthly prize draw.

As you consider investing in Premium Bonds, it’s crucial to weigh the pros and cons and make an informed decision. By doing so, you can potentially reap the rewards of this unique investment opportunity and achieve your long-term financial goals.