Gen Z Drives UK Savings Boom

Gen Z Fuels Savings Boom in the UK

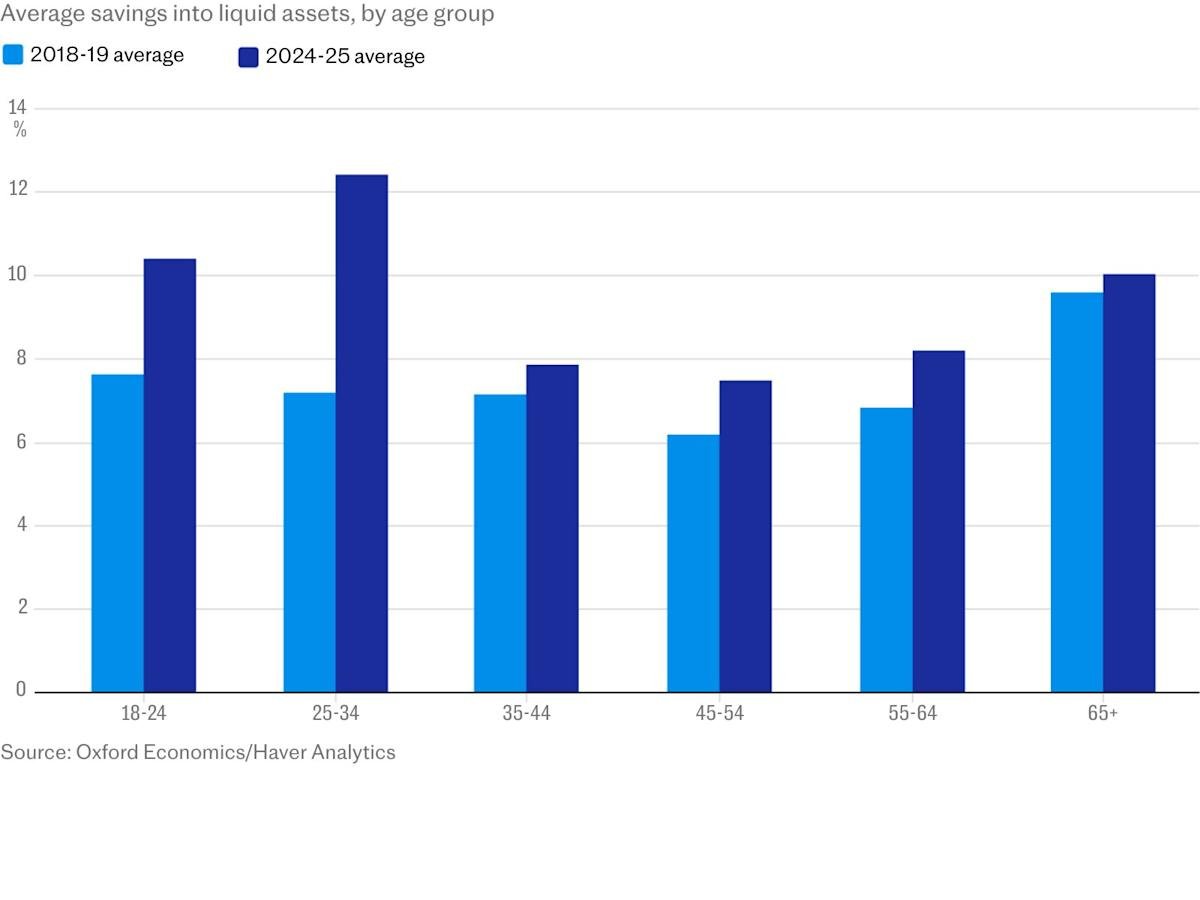

Gen Z’s behaviour towards savings has seen a significant shift, with many young people prioritising saving over spending. This change in behaviour is largely driven by financial uncertainty and a desire for long-term security. As a result, the UK is experiencing a savings boom, with Gen Z at the forefront. The colour of the UK’s financial landscape is changing, with a new generation of savers emerging.

The UK’s savings rate has increased dramatically, with Gen Z leading the charge. This surge in savings has been driven by a combination of factors, including low interest rates and a lack of job security. As a result, many young people are choosing to save rather than spend, in an effort to build up their savings and secure their financial future. The financial services sector is taking notice, with many banks and building societies offering new savings products tailored to Gen Z’s needs.

So, what is driving Gen Z’s behaviour towards savings? One key factor is the rising cost of living, which is forcing many young people to be more frugal and save for the future. Additionally, the impact of the pandemic has made many Gen Zers more cautious and risk-averse, leading them to prioritise saving over spending. The UK government is also playing a role, with initiatives such as the Lifetime ISA and Help to Buy scheme encouraging young people to save for the future.

The savings boom has significant implications for the UK economy, with potential benefits including increased economic growth and stability. However, there are also potential risks, such as a decrease in consumer spending and a rise in debt. As the UK’s savings landscape continues to evolve, it will be important to analyse the impact of Gen Z’s behaviour and adjust policies accordingly. The financial sector must also adapt to meet the changing needs of savers, providing innovative products and services that cater to Gen Z’s unique requirements.

In conclusion, Gen Z is driving a savings boom in the UK, with significant implications for the economy and the financial sector. As this trend continues, it will be essential to monitor the impact and adjust policies to ensure the long-term stability of the UK’s financial system. With the right approach, the UK can harness the power of Gen Z’s savings boom and create a more secure financial future for all.

The UK’s financial regulators are also taking notice of the savings boom, with the Financial Conduct Authority (FCA) launching initiatives to promote financial literacy and encourage responsible saving. The FCA’s efforts are aimed at ensuring that Gen Z savers have access to the information and resources they need to make informed decisions about their finances. By promoting financial education and awareness, the FCA hopes to empower Gen Z to take control of their financial lives and make the most of the savings boom.

As the savings boom continues to gather momentum, it will be interesting to see how the UK’s financial landscape evolves. One thing is certain, however: Gen Z is leading the charge towards a more secure financial future, and their behaviour will have a lasting impact on the UK’s economy and financial sector. The colour of the UK’s financial landscape is changing, and it will be exciting to see what the future holds for this new generation of savers.

The savings boom is not just limited to the UK, with many other countries experiencing similar trends. The global economy is becoming increasingly interconnected, and the behaviour of Gen Z savers in the UK is likely to have a ripple effect on the global financial system. As the world becomes more financially intertwined, it will be essential to monitor the impact of the savings boom and adjust policies to ensure stability and growth.

In the UK, the savings boom is being driven by a combination of factors, including low interest rates, a lack of job security, and a rising cost of living. The UK government is responding to these challenges by introducing initiatives such as the National Living Wage and the Pensions Dashboard, which aim to promote financial stability and security. The financial sector is also playing a crucial role, with many banks and building societies offering innovative savings products and services tailored to Gen Z’s needs.

As the UK’s savings landscape continues to evolve, it will be important to analyse the impact of Gen Z’s behaviour and adjust policies accordingly. The financial sector must also adapt to meet the changing needs of savers, providing innovative products and services that cater to Gen Z’s unique requirements. By working together, the UK can harness the power of the savings boom and create a more secure financial future for all.

The future of the UK’s financial system looks bright, with Gen Z leading the charge towards a more secure and stable financial future. As the savings boom continues to gather momentum, it will be exciting to see how the UK’s financial landscape evolves and how the country can benefit from this new generation of savers. The UK’s financial regulators, government, and financial sector must work together to ensure that the savings boom is harnessed for the benefit of all, and that the UK’s financial system remains stable and secure.

The savings boom is a positive trend, but it also presents challenges and risks. The UK’s financial sector must be vigilant and adaptable, responding to the changing needs of savers and providing innovative products and services that cater to Gen Z’s unique requirements. By doing so, the UK can ensure that the savings boom is a success, and that the country’s financial system remains stable and secure for generations to come.