Emerging Markets Surge on AI Investment

Emerging-Market Stock Index Nears Five-Year High

The emerging-market stock index has reached a five-year high, driven by significant investment in artificial intelligence (AI) and technology sectors. This surge in investment has led to increased economic activity and growth. The index’s performance is a testament to the growing importance of emerging markets.

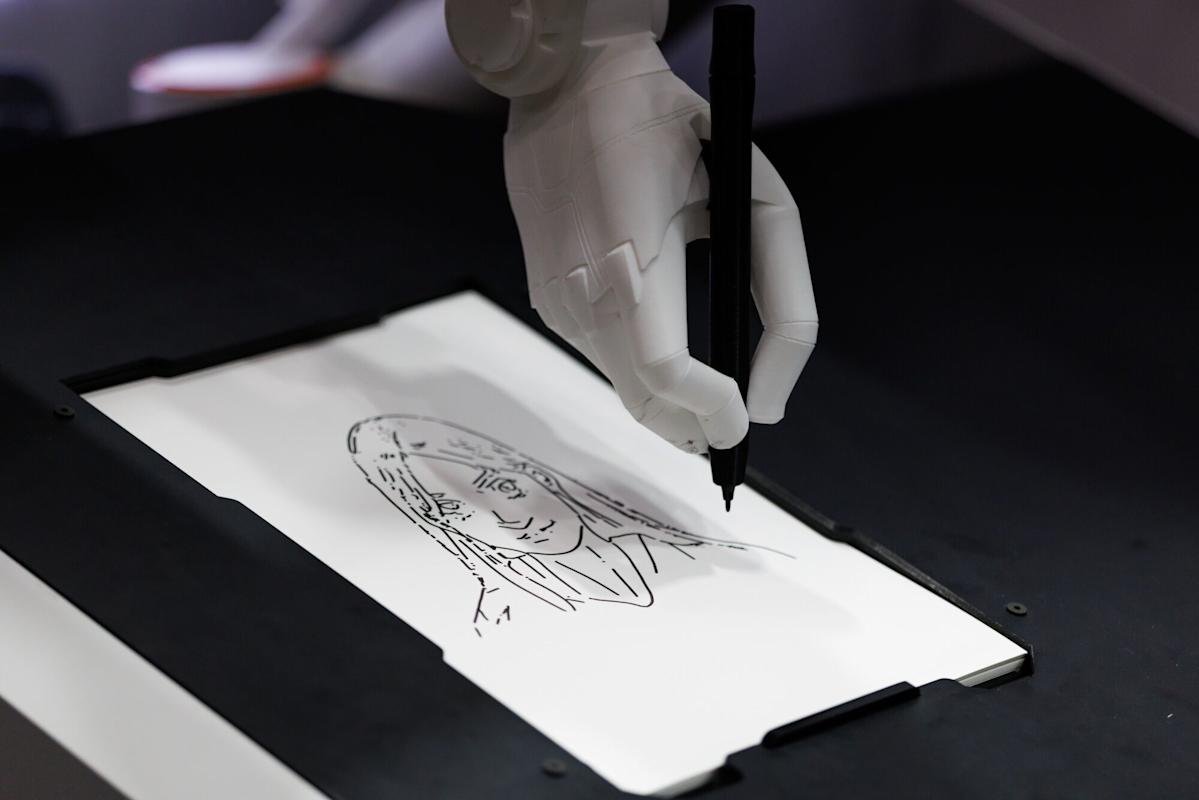

The AI sector has been a major driver of this growth, with many emerging-market companies investing heavily in AI research and development. This investment has led to the creation of new jobs and industries, further boosting economic growth. As a result, the emerging-market stock index has become an attractive option for investors.

The current trend is expected to continue, with many analysts predicting further growth in the emerging-market stock index. The increasing adoption of AI and other technologies is likely to drive this growth, as emerging-market companies become more competitive and innovative. However, there are also potential risks and challenges associated with this growth.

Investors should carefully analyse the market trends and behaviour of emerging-market companies before making any investment decisions. It is essential to consider the potential risks and rewards of investing in emerging markets, as well as the overall economic and political context. By doing so, investors can make informed decisions and navigate the complex world of emerging-market investments.

The UK’s financial sector has also been impacted by the growth of emerging markets, with many UK-based companies investing in emerging-market stocks. This has led to increased economic activity and job creation in the UK, as well as opportunities for UK businesses to expand into new markets. As the emerging-market stock index continues to grow, it is likely that the UK’s financial sector will become increasingly intertwined with emerging markets.

Furthermore, the growth of emerging markets has significant implications for the global economy. As emerging-market companies become more competitive and innovative, they are likely to play a larger role in shaping the global economic landscape. This, in turn, will create new opportunities and challenges for businesses and investors around the world.

In conclusion, the emerging-market stock index’s surge to a five-year high is a significant development, driven by investment in AI and technology sectors. As the index continues to grow, it is essential for investors to carefully consider the potential risks and rewards of investing in emerging markets. By doing so, they can navigate the complex world of emerging-market investments and make informed decisions.

The future of emerging markets looks promising, with many analysts predicting continued growth and investment in the sector. As the global economy becomes increasingly interconnected, it is likely that emerging markets will play a larger role in shaping the economic landscape. Investors and businesses must be prepared to adapt to these changes and navigate the opportunities and challenges that they present.

Ultimately, the growth of emerging markets is a testament to the power of innovation and investment. As emerging-market companies continue to invest in AI and other technologies, they are likely to become increasingly competitive and innovative. This, in turn, will drive economic growth and create new opportunities for businesses and investors around the world.

However, it is also important to consider the potential risks associated with investing in emerging markets. These risks include economic and political instability, as well as the potential for market volatility. Investors must carefully weigh these risks against the potential rewards of investing in emerging markets, and make informed decisions based on their individual circumstances and goals.

By taking a careful and informed approach to investing in emerging markets, investors can navigate the complex world of emerging-market investments and achieve their financial goals. Whether you are a seasoned investor or just starting out, it is essential to stay up-to-date with the latest developments and trends in the emerging-market sector.

In the UK, investors can access a range of resources and information to help them make informed decisions about emerging-market investments. These resources include financial news and analysis, as well as guidance from financial experts and advisors. By taking advantage of these resources, investors can gain a deeper understanding of the emerging-market sector and make informed decisions about their investments.

The emerging-market stock index’s surge to a five-year high is a significant development, and one that is likely to have far-reaching implications for the global economy. As investors and businesses navigate the complex world of emerging-market investments, they must be prepared to adapt to changing market trends and conditions. By doing so, they can capitalize on the opportunities presented by emerging markets and achieve their financial goals.