Dollar’s Worst Year Since 2017

Dollar Posts Worst Yearly Performance Since 2017

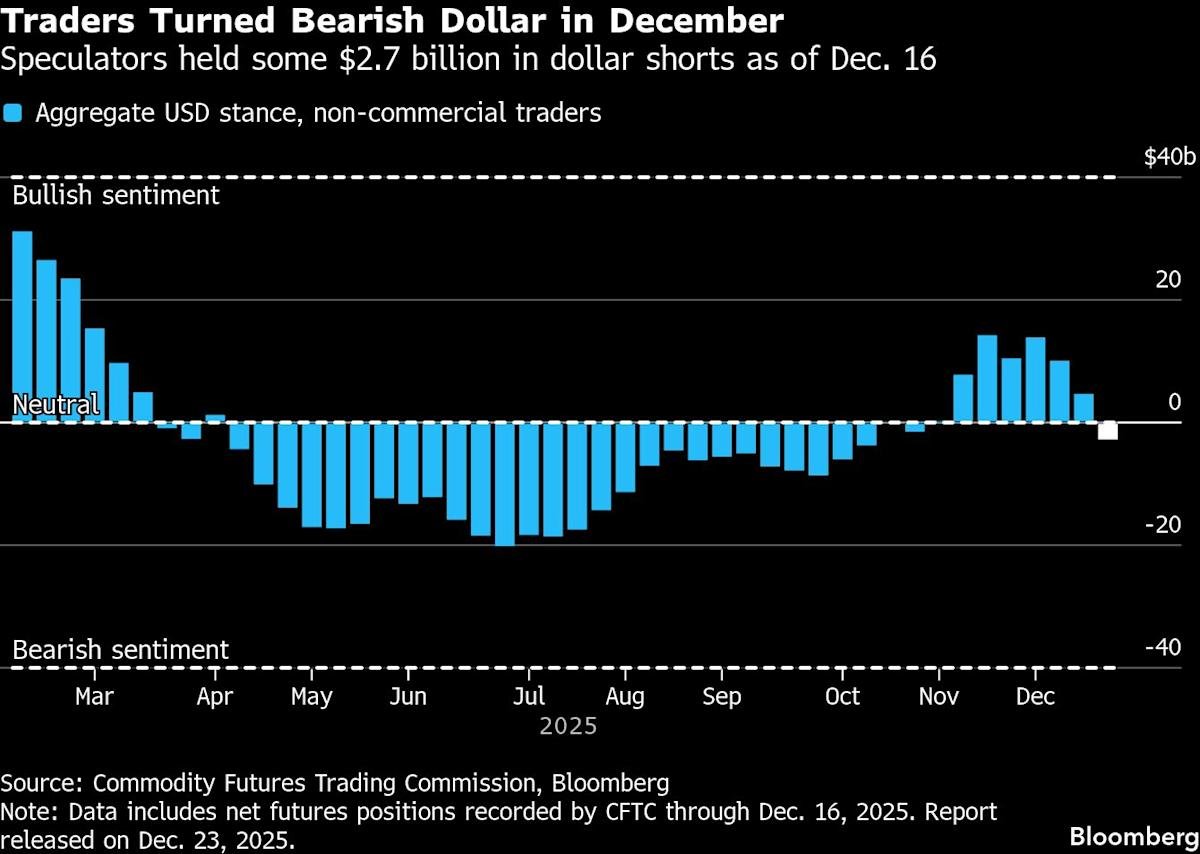

The US dollar has posted its worst yearly performance since 2017, with many analysts expecting further interest rate cuts by the Federal Reserve. This downturn has significant implications for global markets and investors. The dollar’s behaviour has been closely watched by financial experts.

The Federal Reserve’s monetary policy decisions have been a key factor in the dollar’s decline. With more Fed cuts expected, investors are analysing the potential impact on their portfolios. The colour of the dollar’s future remains uncertain, with many factors at play.

The dollar’s decline has been influenced by various economic factors, including trade tensions and geopolitical uncertainty. As the global economy continues to evolve, it is essential to stay informed about the latest developments. The dollar’s performance has a significant impact on international trade and finance.

Investors are advised to monitor the dollar’s movement closely and adjust their investment strategies accordingly. The dollar’s value can fluctuate rapidly, and staying up-to-date with market news is crucial. By analysing the dollar’s behaviour, investors can make informed decisions about their investments.

The UK’s financial sector is also affected by the dollar’s performance, as many British companies have international operations. The dollar’s decline can have a significant impact on their revenue and profitability. As the dollar’s future remains uncertain, it is essential for businesses to be prepared for any eventuality.

The Federal Reserve’s future decisions will be closely watched by financial experts and investors. The dollar’s performance will continue to be influenced by various economic factors, including inflation and employment rates. As the global economy continues to evolve, it is essential to stay informed about the latest developments.

In conclusion, the dollar’s worst yearly performance since 2017 has significant implications for global markets and investors. With more Fed cuts expected, it is essential to stay informed about the latest developments and adjust investment strategies accordingly. The dollar’s future remains uncertain, and monitoring its movement closely is crucial.