Build £1,000 Monthly Passive Income

Building £1,000 Monthly Passive Income with an ISA

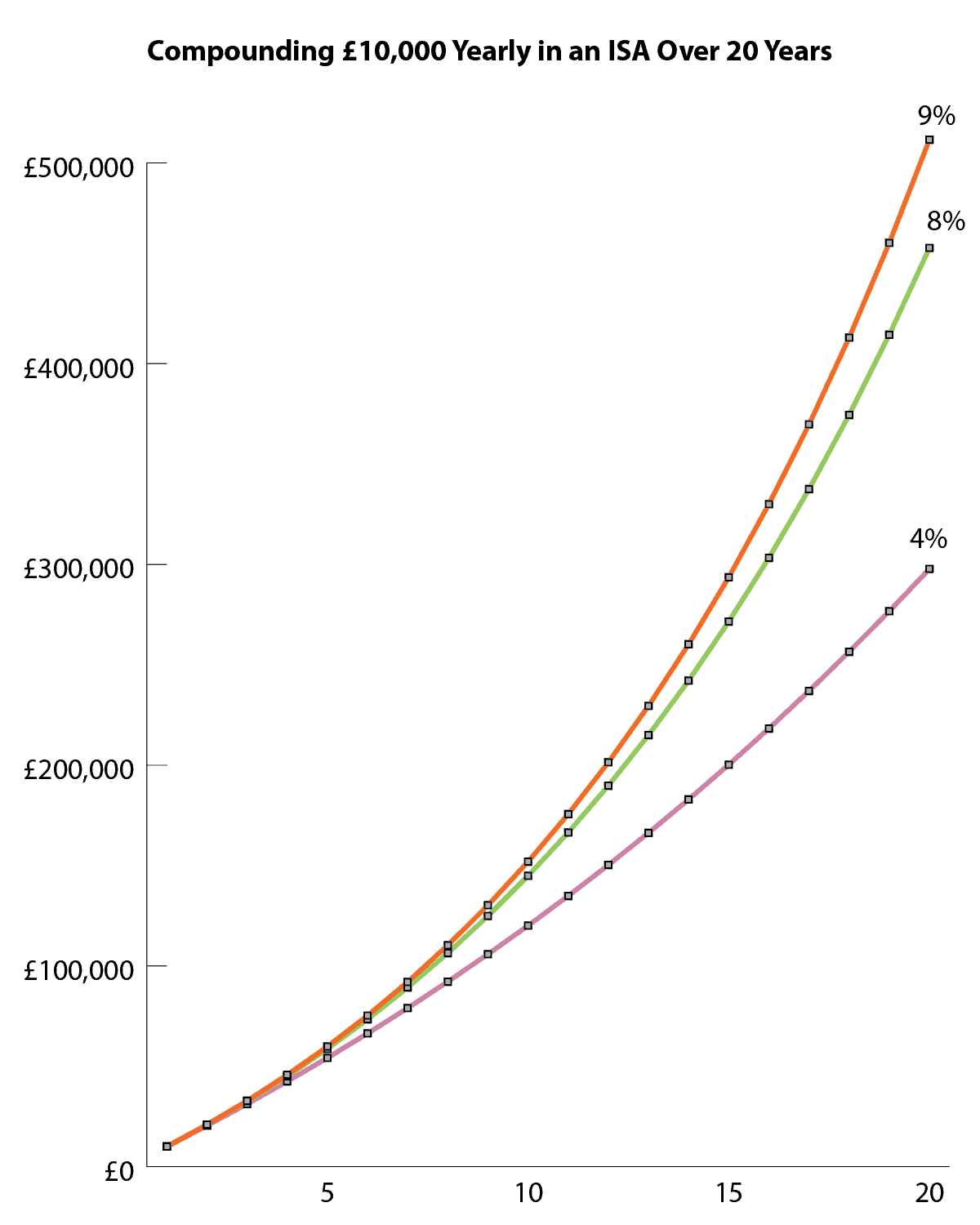

To build £1,000 a month in passive income using an ISA, it’s essential to analyse your financial behaviour and create a solid investment strategy. This involves considering your risk tolerance, investment horizon, and financial goals. By doing so, you can make informed decisions about your investments and potentially achieve your target income.

A suitable approach is to diversify your portfolio by investing in a range of assets, such as stocks, bonds, and property. This can help spread risk and increase the potential for long-term returns. Additionally, it’s crucial to consider the tax implications of your investments and how they may impact your overall financial situation.

Another key aspect is to educate yourself on personal finance and investing, staying up-to-date with the latest market trends and news. This can help you make informed decisions and adjust your strategy as needed. Furthermore, it’s essential to be patient and disciplined, as building passive income takes time and effort.

By following these steps and maintaining a well-diversified portfolio, you can increase your chances of achieving £1,000 a month in passive income using an ISA. It’s also important to regularly review and adjust your strategy to ensure it remains aligned with your financial goals.

In terms of specific investment options, you may consider index funds, dividend-paying stocks, or peer-to-peer lending. These can provide a relatively stable source of income and potentially lower risk. However, it’s essential to carefully evaluate each option and consider your individual circumstances before making a decision.

Ultimately, building £1,000 a month in passive income using an ISA requires careful planning, patience, and discipline. By following a well-structured approach and staying informed, you can increase your chances of achieving your financial goals and securing a stable income stream.

It’s also worth considering the benefits of tax-efficient investing and how it can help maximise your returns. By utilising tax-free allowances and investing in tax-efficient vehicles, you can potentially reduce your tax liability and increase your overall wealth.

In conclusion, building £1,000 a month in passive income using an ISA is achievable with the right strategy and mindset. By educating yourself, diversifying your portfolio, and staying disciplined, you can increase your chances of success and secure a stable financial future.