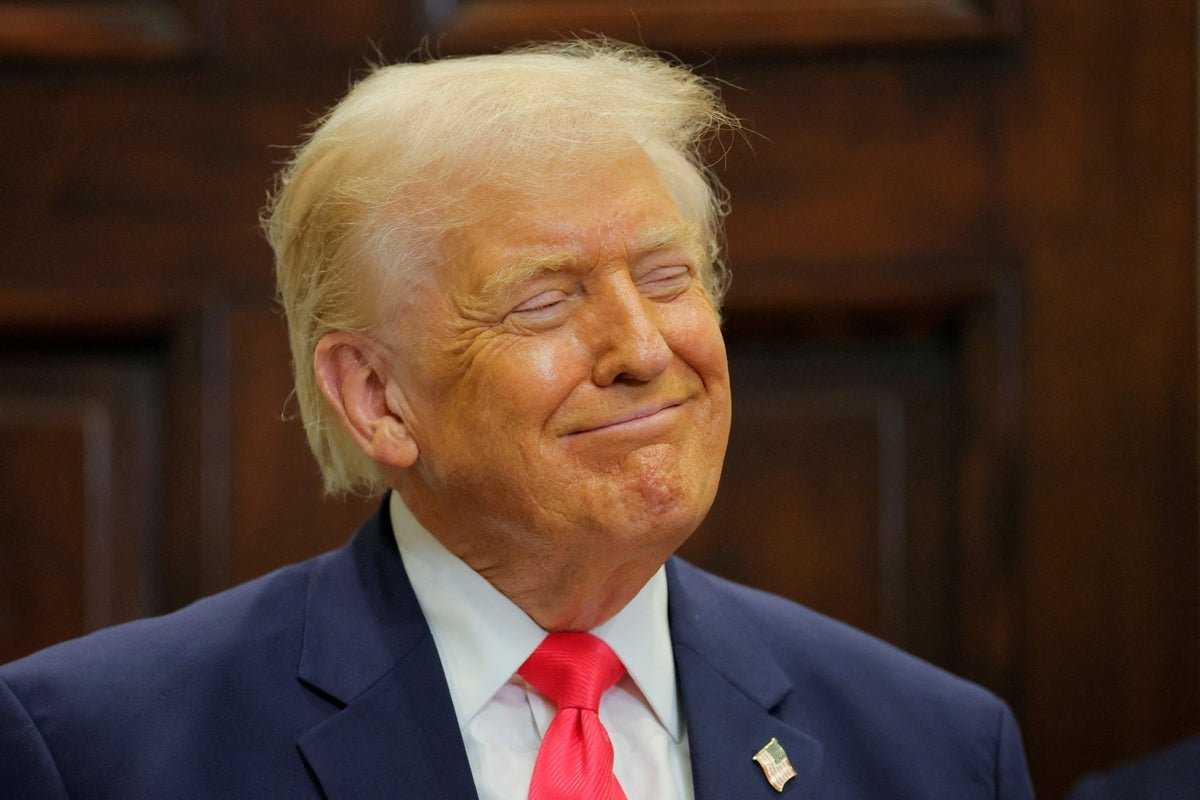

Trump’s $200bn Mortgage Bond Buy: Will It Cut Costs?

Will Trump’s $200 Billion Mortgage Bond Buy Lower Housing Costs?

The US mortgage market is abuzz with the news of Trump’s $200 billion mortgage bond buy. But what does this mean for UK homeowners and prospective buyers? The move is expected to inject liquidity into the market, potentially leading to lower mortgage rates.

However, experts warn that the impact on housing costs may be limited. The UK’s housing market behaviour is influenced by a multitude of factors, including Brexit uncertainty and colour changes in government policies. As such, it’s crucial to analyse the potential effects of this bond buy on the UK’s mortgage landscape.

Mortgage rates have been on a downward trend in recent months, thanks to the Bank of England’s monetary policy decisions. But with the UK’s economy facing headwinds, it’s uncertain whether this trend will continue. The $200 billion mortgage bond buy may provide a temporary boost, but it’s unlikely to be a silver bullet for the UK’s housing affordability woes.

The UK’s housing market is a complex beast, with many factors at play. While Trump’s bond buy may have a positive impact on mortgage rates, it’s essential to consider the broader context. The government’s recent announcements on housing policy, including plans to increase funding for affordable housing, may have a more significant impact on the market.

Only time will tell whether Trump’s $200 billion mortgage bond buy will have a lasting impact on the UK’s housing market. As the situation unfolds, it’s crucial for prospective buyers and homeowners to stay informed about the latest developments and how they may affect their mortgage costs.

In conclusion, while the $200 billion mortgage bond buy is an interesting development, its impact on the UK’s housing market is uncertain. As the market continues to evolve, it’s essential to keep a close eye on the latest news and trends to make informed decisions about your mortgage.