TSMC Shares Surge After Goldman Upgrade

TSMC Shares Jump Most Since April

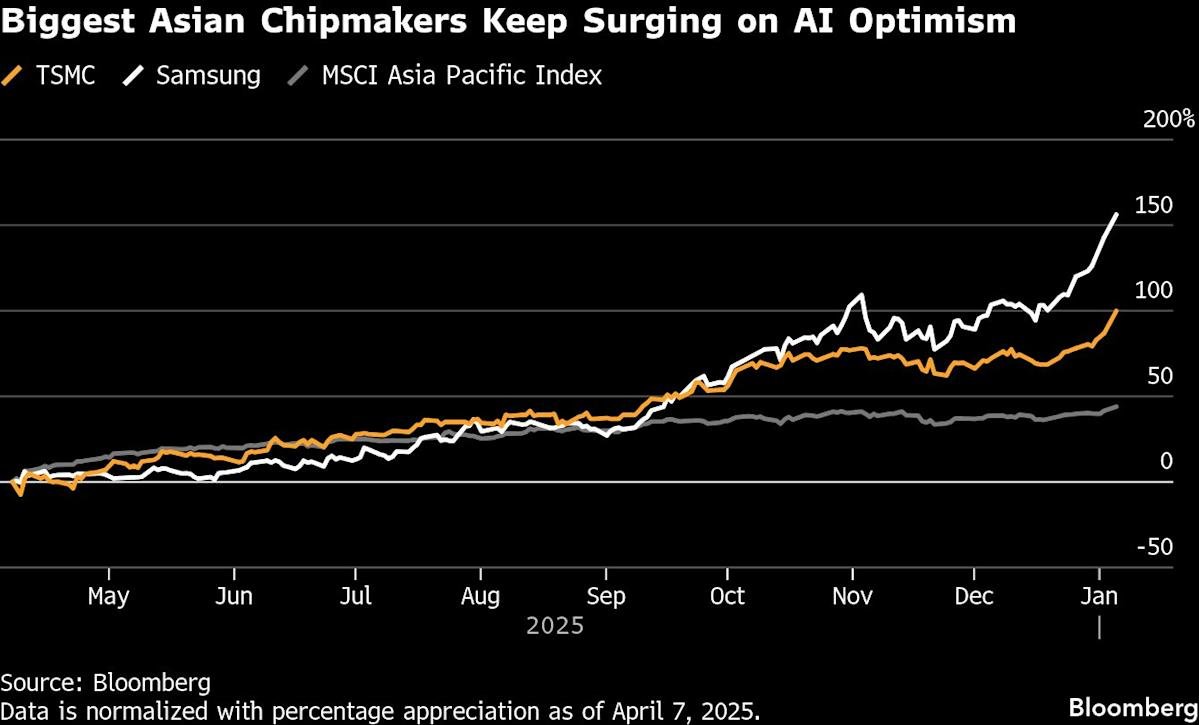

TSMC shares experienced their largest increase since April after Goldman Sachs lifted its target by 35%. This significant upgrade has sparked interest among investors.

The Taiwanese semiconductor company has been performing well, driven by strong demand for its products. Goldman’s decision to raise its target reflects the company’s positive outlook.

TSMC’s success can be attributed to its innovative manufacturing processes and commitment to research and development. The company’s behaviour in the market has been impressive, with a steady increase in share price.

Analysts believe that TSMC’s shares will continue to rise, driven by the growing demand for semiconductors. The company’s colour palette of products is diverse, catering to various industries and applications.

To analyse the situation, experts consider the global semiconductor market and its trends. TSMC’s position in the market is strong, with a significant market share.

The company’s financial performance has been impressive, with increasing revenue and profit. Investors are keen to know more about TSMC’s future plans and strategies.

TSMC’s shares are expected to remain volatile, influenced by market trends and economic conditions. However, the company’s fundamentals are strong, making it an attractive investment opportunity.

Investors should carefully consider their investment decisions, taking into account the company’s behaviour and performance. It is essential to analyse the market and the company’s position before making any investment decisions.

The demand for semiconductors is expected to continue growing, driven by emerging technologies. TSMC is well-positioned to benefit from this trend, with its advanced manufacturing capabilities.

In conclusion, TSMC’s shares have surged after Goldman’s upgrade, reflecting the company’s positive outlook. Investors should carefully consider their investment decisions, analysing the company’s behaviour and performance.