ISA Passive Income for Life

Generating £1,000 Monthly Passive Income from ISAs

Individual Savings Accounts (ISAs) are a popular way to save and invest in the UK, offering tax-free benefits and flexible investment options. To generate £1,000 a month in passive income, you’ll need to consider your investment goals and risk tolerance. A well-diversified portfolio is crucial for long-term success.

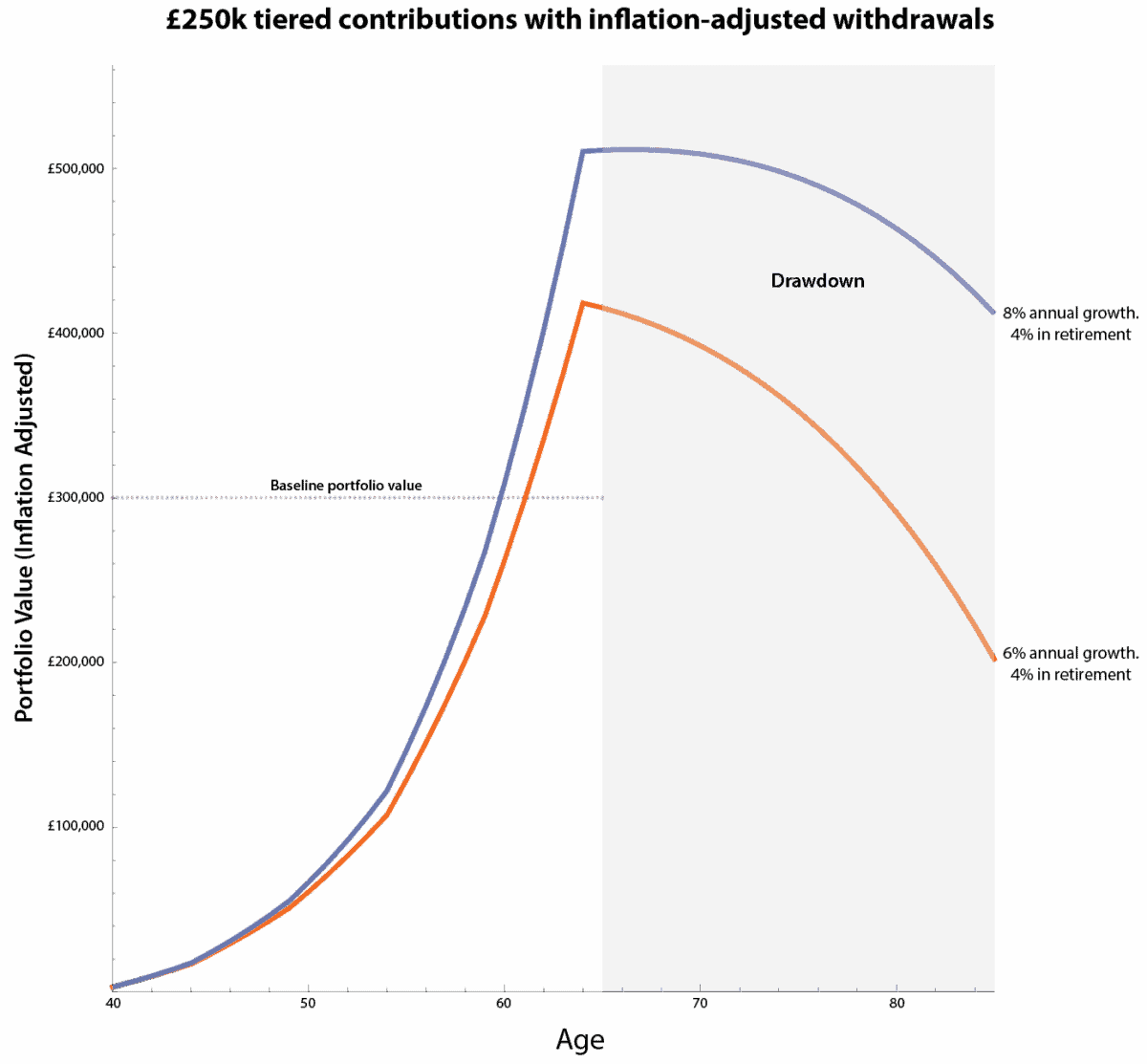

Assuming an average annual return of 4-6%, it’s possible to estimate the required investment amount. A £200,000 to £300,000 investment could potentially yield £1,000 a month in passive income. However, this depends on various factors, including the investment type and market behaviour.

When investing in an ISA, it’s essential to analyse your financial situation and goals. Consider your risk tolerance, investment horizon, and expected returns. A financial advisor can help you create a tailored investment plan, ensuring you’re on track to meet your objectives.

ISAs offer a range of investment options, including stocks and shares, cash, and innovative finance. Each type has its benefits and risks, and it’s crucial to understand these before investing. By making informed decisions and maintaining a long-term perspective, you can increase your chances of generating £1,000 a month in passive income from your ISA.

To achieve this goal, it’s vital to adopt a disciplined investment approach. Regularly review your portfolio, and make adjustments as needed to ensure you’re on track. Consider consulting a financial expert to help you navigate the investment landscape and make informed decisions.

Additionally, it’s essential to consider the impact of inflation and taxes on your investment returns. A tax-efficient investment strategy can help you maximise your returns and achieve your financial goals. By taking a proactive approach to investment management, you can increase your chances of success and enjoy a more secure financial future.

In conclusion, generating £1,000 a month in passive income from an ISA requires careful planning, discipline, and patience. By understanding your investment options, managing risk, and maintaining a long-term perspective, you can work towards achieving your financial goals and enjoying a more secure retirement.