Capital Gains Tax Explained

Understanding Capital Gains Tax on Property

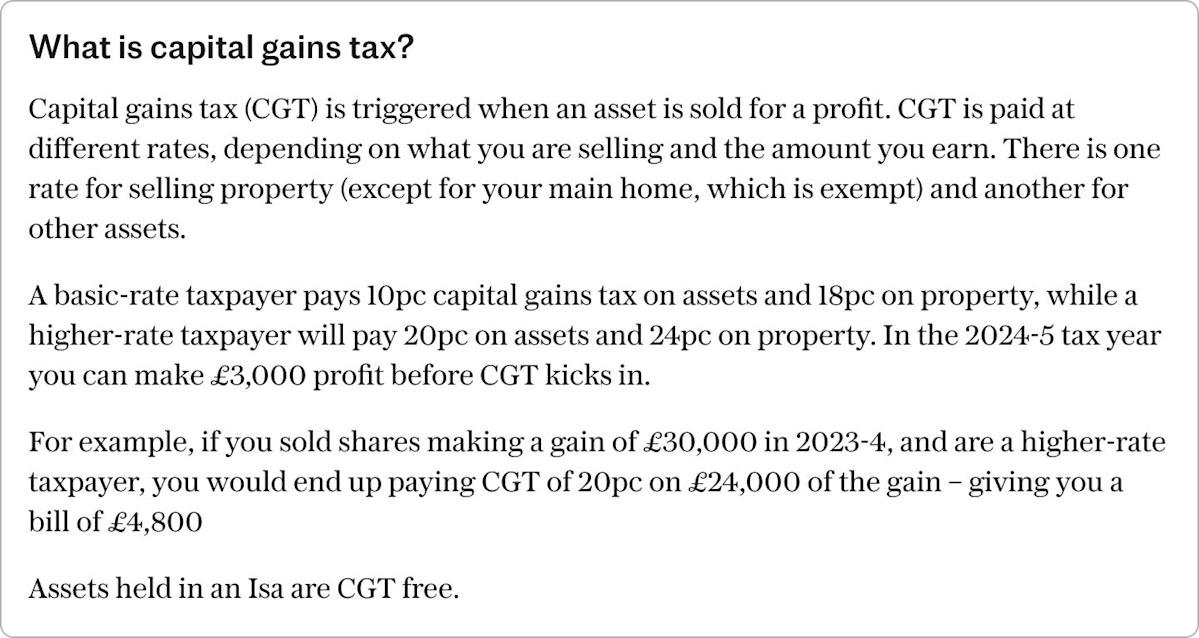

Capital gains tax is a type of tax levied on the profit made from selling an asset, such as a property. The tax is calculated based on the gain made, rather than the total sale price. In the UK, capital gains tax rates vary depending on the individual’s income tax band.

The tax-free allowance for capital gains tax is £12,000 for the 2022-2023 tax year. This means that if the gain made on the sale of a property is below this threshold, no tax will be payable. However, if the gain exceeds this amount, tax will be charged at the applicable rate.

There are two main rates of capital gains tax: 18% and 28%. The 18% rate applies to basic-rate taxpayers, while the 28% rate applies to higher-rate and additional-rate taxpayers. The tax rate will depend on the individual’s income tax band at the time of the sale.

It’s essential to understand how capital gains tax works and how it may affect property sales. Individuals can minimise their tax liability by using exemptions, such as private residence relief, or by using tax-efficient strategies, such as selling assets in a tax-efficient order.

Private residence relief is a valuable exemption that can reduce or eliminate capital gains tax liability. To qualify for this relief, the property must have been the individual’s main residence at some point during the period of ownership. The relief can be claimed for the entire period of ownership, or for a proportion of the period, depending on the circumstances.

In addition to private residence relief, there are other exemptions and reliefs available, such as lettings relief and entrepreneurs’ relief. Lettings relief can provide a reduction in capital gains tax liability for individuals who have let out their property, while entrepreneurs’ relief can provide a reduced rate of tax for individuals who are selling a business asset.

Capital gains tax can be complex, and it’s crucial to seek professional advice to ensure that the correct amount of tax is paid. A tax advisor or accountant can help individuals navigate the rules and regulations, and provide guidance on how to minimise tax liability.

In conclusion, capital gains tax on property can be a significant consideration for individuals selling a property. By understanding how the tax works and using exemptions and reliefs, individuals can reduce their tax liability and ensure that they are not paying more tax than necessary.