Big Trades 2025: UK Market Outlook

UK Market Trends to Watch in 2025

The UK financial market is poised for significant changes in 2025, with various trades expected to shape the economy. Investors are keenly watching the market, analysing trends and behaviour to make informed decisions. The year is expected to bring a mix of opportunities and challenges, with some trades potentially yielding high returns.

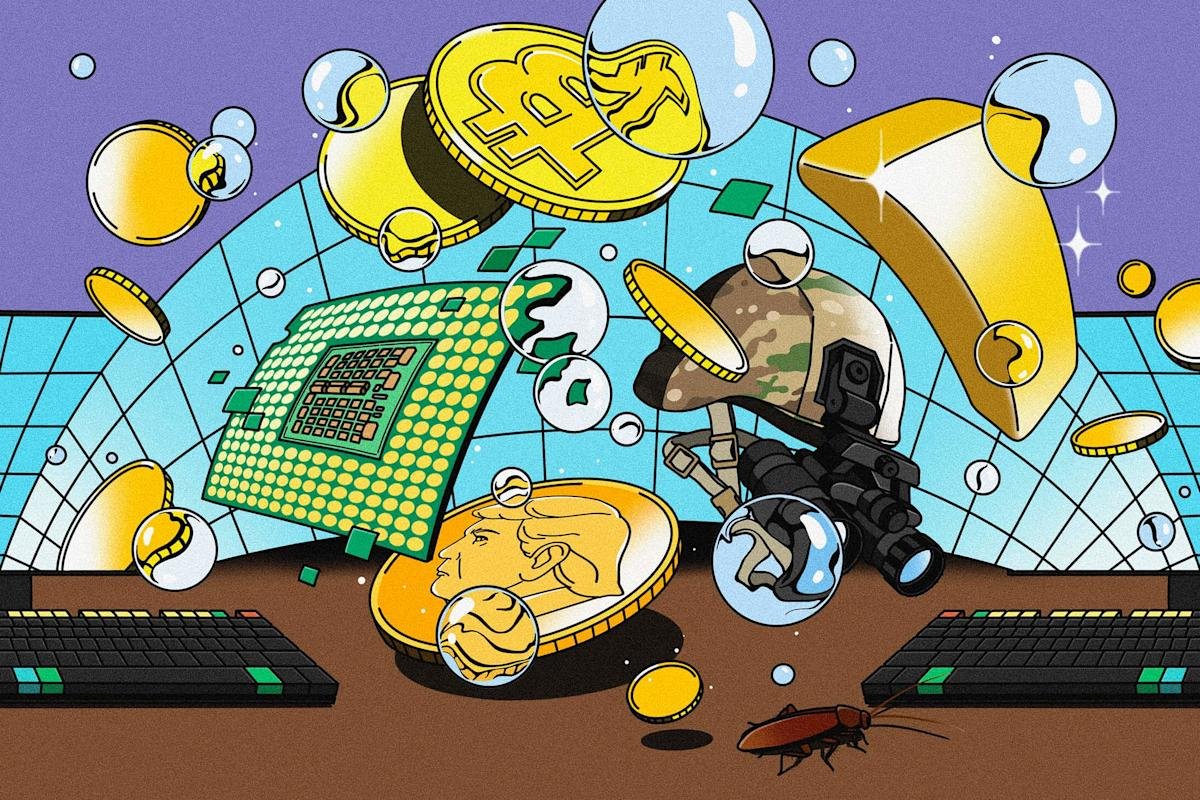

One of the key areas to focus on is the potential for bubbles in certain sectors, which could lead to significant losses if not managed properly. On the other hand, some trades may prove to be more resilient, much like cockroaches, and provide a safer haven for investors. The UK market is known for its unpredictability, and 2025 is expected to be no different.

A closer look at the market trends reveals a potential 367% jump in certain sectors, which could be a game-changer for investors. However, it is crucial to approach such opportunities with caution and carefully consider the risks involved. The UK financial market is heavily influenced by global events, and investors must stay up-to-date with the latest news and developments to make informed decisions.

In addition to the potential for high returns, the UK market is also expected to be impacted by various economic factors, including inflation, interest rates, and Brexit. Investors must carefully analyse these factors and their potential impact on the market to make informed decisions. The behaviour of investors and consumers will also play a significant role in shaping the market, and understanding these trends will be crucial for success.

The UK government’s policies and regulations will also have a significant impact on the market, and investors must stay informed about any changes or developments. The colour of the market is expected to be influenced by the government’s decisions, and investors must be prepared to adapt to any changes. By staying informed and up-to-date with the latest news and trends, investors can make informed decisions and navigate the UK market with confidence.

As the UK market continues to evolve, it is essential for investors to stay ahead of the curve and be prepared for any eventuality. By analysing the market trends and understanding the potential risks and opportunities, investors can make informed decisions and achieve their financial goals. The UK market is known for its complexity, and investors must be prepared to navigate its twists and turns to succeed.

In conclusion, the UK market is expected to be shaped by various trades in 2025, each with its own potential risks and opportunities. By understanding the market trends and staying informed, investors can make informed decisions and achieve their financial goals. Whether it is a potential 367% jump or a more cautious approach, the key to success lies in careful analysis and a deep understanding of the market.

Investors must also consider the potential for cockroaches in the market, which can provide a safer haven in times of uncertainty. By diversifying their portfolios and staying informed, investors can reduce their risks and increase their potential for returns. The UK market is full of opportunities, and investors who are prepared to take calculated risks can reap significant rewards.

As the year unfolds, it will be essential to keep a close eye on the market trends and adjust investment strategies accordingly. By staying informed and up-to-date with the latest news and developments, investors can make informed decisions and navigate the UK market with confidence. The potential for high returns is significant, but it is crucial to approach the market with caution and careful analysis.

The UK financial market is a complex and ever-changing entity, and investors must be prepared to adapt to any changes or developments. By understanding the market trends and staying informed, investors can make informed decisions and achieve their financial goals. Whether it is a potential 367% jump or a more cautious approach, the key to success lies in careful analysis and a deep understanding of the market.

Finally, it is essential to consider the potential impact of global events on the UK market. Investors must stay informed about the latest news and developments from around the world and understand how these events may shape the market. By doing so, investors can make informed decisions and navigate the UK market with confidence, even in times of uncertainty.