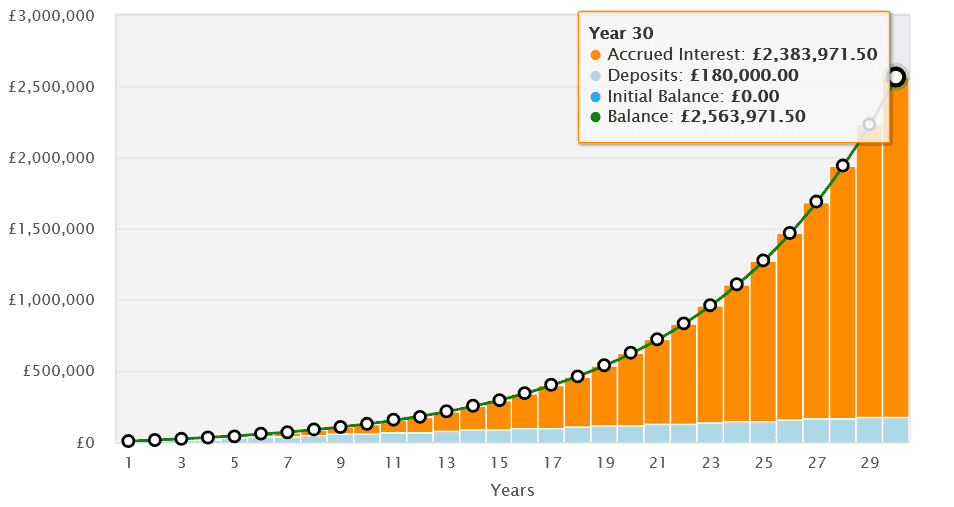

Retire in Style: £2.6m Fund

Building a £2.6m Retirement Fund: Investment Trusts to Consider

As the UK’s State Pension continues to face uncertainty, many are turning to investment trusts to secure their retirement. With a target of £2.6m, investors are looking for reliable and high-yielding options. The Finsbury Growth & Income Trust, The Scottish Investment Trust, and The Witan Investment Trust are three investment trusts worth considering.

These trusts have consistently demonstrated strong performance and a stable track record, making them attractive to those seeking long-term growth. By investing in a diversified portfolio of UK and international stocks, investors can potentially achieve their retirement goals.

The Finsbury Growth & Income Trust, for example, has a history of delivering steady returns, with a focus on dividend-paying stocks. This approach can provide a relatively stable income stream, which is ideal for retirees seeking predictable returns.

In contrast, The Scottish Investment Trust takes a more flexible approach, investing in a range of assets including equities, bonds, and alternative investments. This diversification can help mitigate risk and increase potential returns over the long term.

The Witan Investment Trust, meanwhile, has a strong track record of outperforming its benchmark, with a focus on actively managed portfolios. By leveraging the expertise of experienced fund managers, investors can benefit from a more targeted approach to investment.

When investing in these trusts, it’s essential to consider individual financial circumstances and goals. A £2.6m retirement fund is an ambitious target, and investors should be prepared to take a long-term view. By doing so, they can potentially achieve their objectives and enjoy a comfortable retirement.

Ultimately, investing in investment trusts requires careful consideration and a well-thought-out strategy. By analysing the behaviour of these trusts and understanding the associated risks and rewards, investors can make informed decisions and work towards achieving their retirement goals.

As the UK’s pension landscape continues to evolve, it’s crucial for investors to stay informed and adapt their strategies accordingly. With the right investment trusts and a clear understanding of the market, retirees can look forward to a secure and prosperous future.

By following a disciplined investment approach and maintaining a long-term perspective, investors can increase their chances of success and achieve their desired retirement outcome. Whether you’re nearing retirement or just starting to plan, it’s essential to consider the role of investment trusts in your overall strategy.

In conclusion, the Finsbury Growth & Income Trust, The Scottish Investment Trust, and The Witan Investment Trust are three investment trusts that can help investors target a £2.6m retirement fund. By understanding the characteristics of each trust and considering individual financial circumstances, investors can make informed decisions and work towards achieving their retirement goals.